Tax Deductible Voluntary Contributions(TVC) is a new type of contributions under the MPF system. In addition to mandatory contribution, employees can open a TVC account to make additional contribution starting from 1 April 2019, to enjoy extra tax incentives from the new scheme. Scheme members can enjoy the flexibility to make TVC to their TVC accounts at any time and in varying amounts. They can also increase or reduce the amount of contributions, or cease to make contributions, or resume the making of contributions at any time, having regard to their personal circumstances.

As the average life expectancy for Hong Kong people is more than 80 years, retirement can potentially last for around 20 years. During retirement, your monthly living expenses, medical fees as well as cost of inflation can cost much more than you expect. Many market research reports and studies have revealed that each Hong Kong citizen would need several millions of dollars for their retirement, which can be an astronomical sum for a typical wage earner. Relying solely on the 10% MPF mandatory contributions made by employers and employees monthly is hardly sufficient. To enjoy a secure retirement life, the best way is to start saving for retirement as early as possible. Take advantage of the power of compound effect and start saving or investing early. The longer your investment time horizon, the stronger the compound effect.

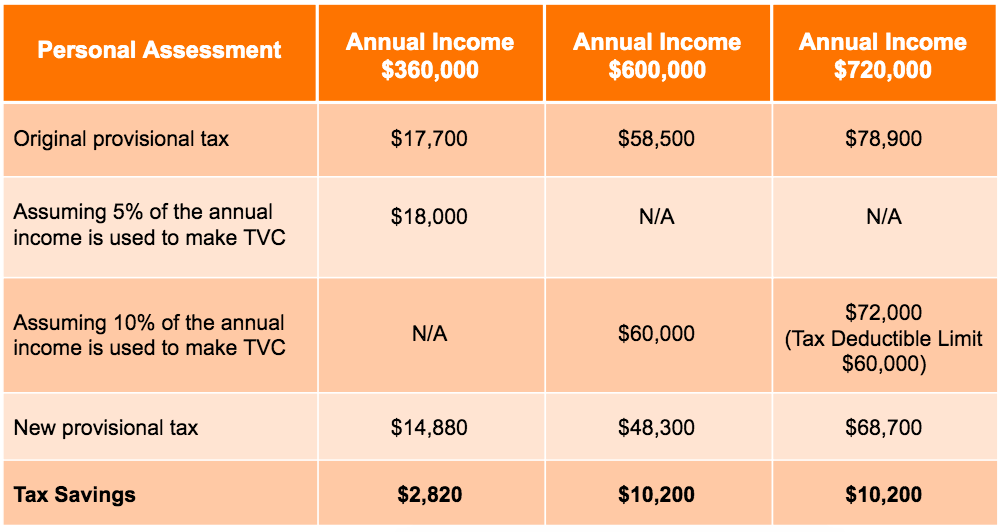

If you have not yet started your retirement savings plan, there is good reason to do so now. Starting from April 2019, retirement savings by way of qualifying deferred annuity policies (“QDAP”) or tax deductible MPF voluntary contributions (“TVC”) could entitle you to tax deductions. The deduction cap is $60,000 per year, which is an aggregate limit for both qualifying deferred annuity premiums and TVC. Based on the prevailing highest tax rate (i.e. 17%), the maximum tax savings can reach up to $10,200 every year!

Example

The examples are for illustration and reference only. While the tax deduction for TVC can help the taxpayer save up to $10,200 per year, it does not mean that any taxpayer who uses up to $60,000 deduction cap can save $10,200 in tax. How much one can save depends on a number of factors, including personal income, entitled tax allowances and deductions, as well as the premiums paid for the QDAP or TVC made, etc.

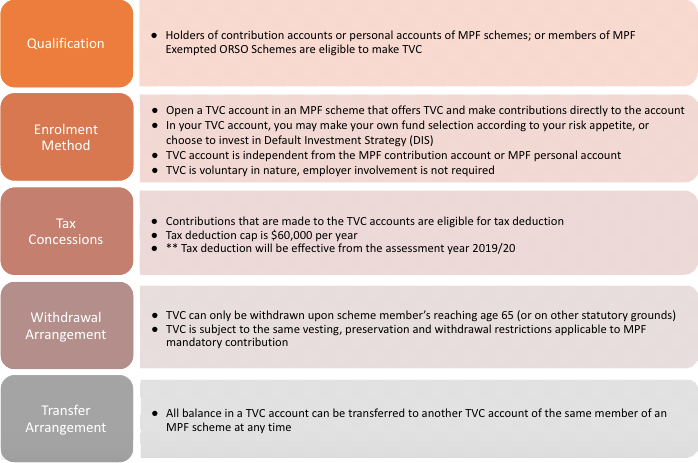

What is Tax Deductible Voluntary Contributions (TVC)?

**The cap is an aggregate limit for both TVC and QDAP premiums.

Three major features of TVC

Tax Deductible Voluntary Contributions (“TVC”) was launched on 1 April 2019. To encourage scheme members to better prepare for retirement, scheme members can enjoy tax deductions by making Tax Deductible Voluntary Contributions starting from the year of assessment 2019-20. The arrangement is simple, convenient and flexible.

View more related information

For more details, please contact us at +852 2887 3012; or complete and submit the form below and we will contact you on the next working day.